Introduction

Despite a balmy January, and a recovery from lows set in November, U.S. growth stocks are still down significantly from their highs at the beginning of 2022.

Last year, amid an overall decline in U.S. stocks, shares of growth companies were hit particularly hard as the S&P 500 Growth index and Nasdaq Composite indexes slumped 33% and 35%, respectively, from peak to trough, respectively. High-profile names like Meta Platforms Inc. (Facebook), PayPal Holdings Inc. and Netflix Inc. fell significantly more, and an index of cloud companies (the BVP Nasdaq Emerging Cloud index) was down 65%.

Are growth companies now attractively priced and at what multiple should they trade in a higher interest rate environment? Market participants often rely on the price/earnings ratio of an index (typically the widely followed S&P 500) and how it compares with the past as an indicator of valuation. This, however, tells us little about the valuation of growth companies (defined here as those with revenue increases of 10% or more annually), let alone high-growth companies (ones boosting revenue at a rate of 20% or more per year).

Historically, at what valuation did those 20%-plus growers trade? This is particularly relevant now because high-growth companies have suffered the steepest decline in share price and have seen their valuations hurt the most by the current cycle of interest rate increases.

We sought to discover where these firms trade relative to their historical averages, particularly compared with periods when interest rates were similar to today.

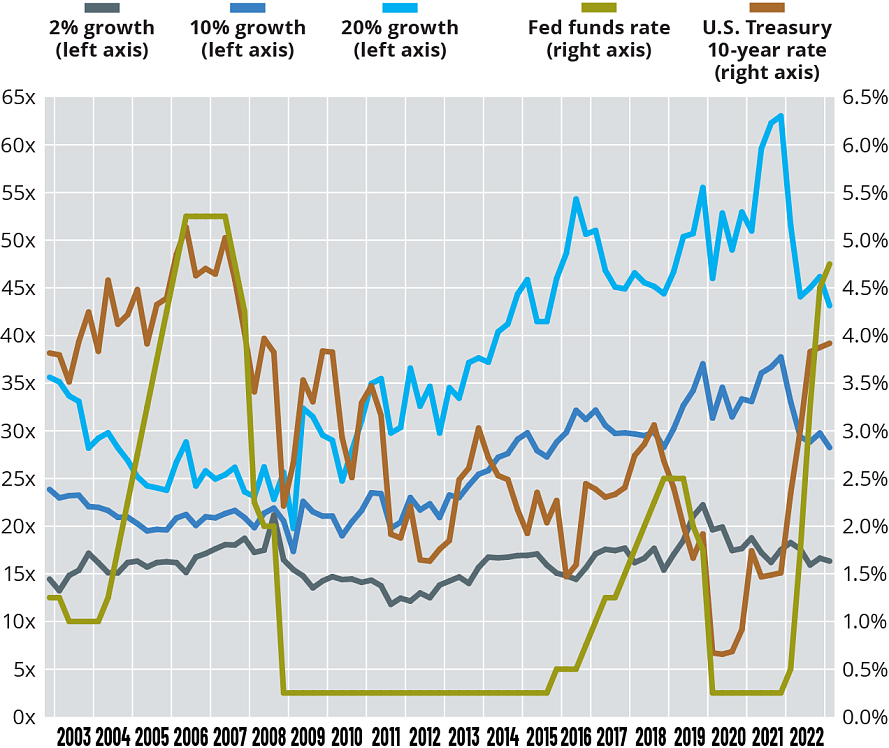

We analyzed all S&P 500 constituents and created a regression of forward PE ratios vs. sell-side analyst expectations for forward growth rates. We repeated that exercise for each quarter over the past 20 years. From the scatter plot trend line we then calculated the average PE ratio over the past 20 years for companies with revenue growth of 2%, 10%, and 20% per year.

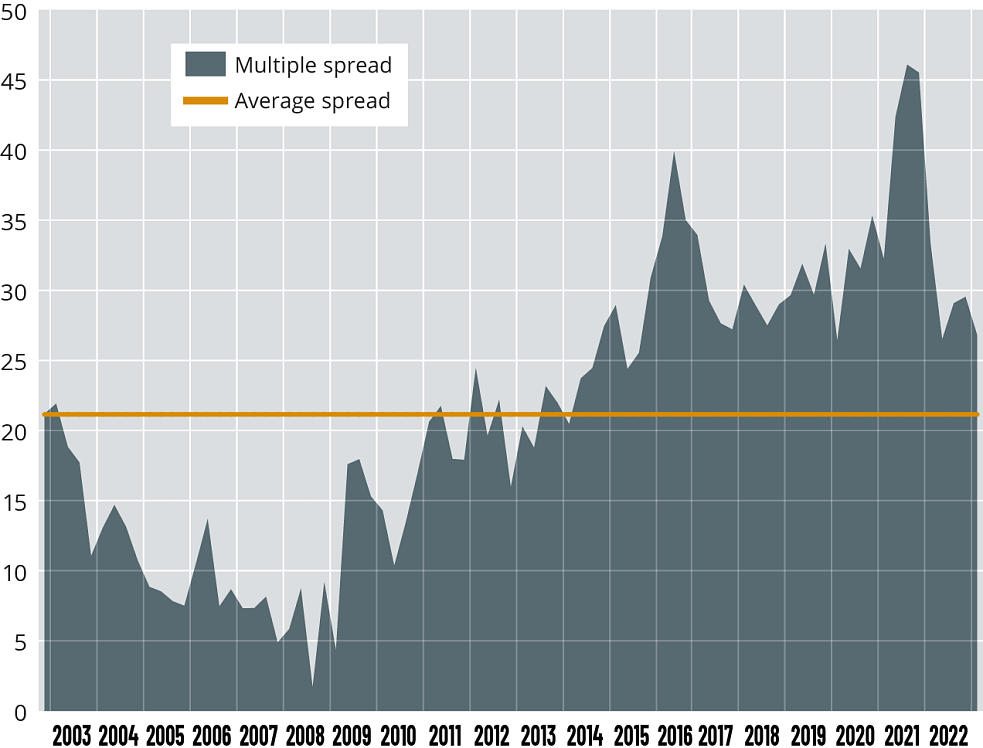

Figure 1 shows the result of this analysis, including the addition of the U.S. federal funds rate and U.S. 10-year Treasury yield. Figure 2 shows the valuation spread between low-growth companies (2% growers) and high-growth companies (20% growers) over the same time.

Figure 1 Forward PE ratio by forward growth rate

Source: Bloomberg LP

Figure 2 20% to 2% multiple dispersion

Source: Bloomberg LP

Key Observations

- High-growth companies have not been this cheap since 2015. As of Feb. 28, high-growth companies traded at an average PE of 43, down from a peak of 63 in the third quarter of 2021 and an average of 47 over the past decade.

- Over a longer 20-year period, current valuations for high-growth companies are still overvalued relative to the average PE of 38.

- Higher interest rates could cause multiples to contract further. The 10-year Treasury yield averaged around 4% from 2002-2007. During that period, high growth companies traded at an average PE of 25.

- This PE multiple of 25 times represents a price/earnings-to-growth ratio, or PEG, of 1.25 and is not too far off from the rule of thumb applied by celebrated Fidelity Magellan fund manager Peter Lynch, who considered a PEG ratio of 1 or less as a potential “good” value.

- The multiple spread between high-growth companies and low-growth companies, shown in Figure 2, has significantly fallen, from a peak of 46 in the third quarter of 2021 to 26 today. That multiple spread is low relative to the past decade, close to its 20-year average.

Takeaway

The takeaway is that companies that grow at 20% a year rarely trade below a PE of 25 times, even if the 10-year Treasury yield settles at around 4%.

Following a dreadful 2022, we are already seeing a number of high-growth companies trading below the long-term average. As we look ahead, we are finding hidden gems (and a margin of safety) among the rubble.

One example of a growth company trading at an attractive price that we’re invested in is London-based Endava. Endava PLC is a technology service provider that helps companies digitize their business. Since its initial public offering in 2018, and led by its founder and CEO John Cotterell, Endava has compounded sales at a 32% compound annual growth rate and free cash flow at a 42% CAGR, while maintaining a return on equity of around 20%. We think Endava’s runway is far from over and we expect it to grow FCF at a CAGR of around 20% for many more years. As of Feb. 28, shares were trading 53% below their highs in 2021. At its recent price, shares trade on a forward price/FCF of 22.

Toronto-based Colliers International Group Inc. is another attractive growth company we’re invested in. Colliers provides investment management, outsourcing and advisory and other services to the commercial real estate market. It spun off from FirstService in 2015 and has followed a disciplined growth-through-acquisition strategy since then. It is run by its founder and CEO Jay Hennick, who has an exceptional track record of capital allocation at Colliers and previously at FirstService. Since becoming a stand-alone public company, Colliers has compounded sales at a CAGR of 15% and adjusted net income at more than 20% per year, while maintaining a return on equity of around 20%. Colliers still has a small market share of the commercial real estate services market, and we expect Colliers to keep growing. At a current forward price/FCF ratio of around 12 times, we think the shares are attractively priced for the growth potential and quality of the business.

Colliers is perceived as a cyclical business, but it has evolved over the past five years. Around 60% of its earnings before interest, taxes, depreciation and amortization, or EBITDA, is now recurring and it has built an investment management business with a sticky revenue base that has grown to around $100 billion of assets under management, a five-fold increase in less than five years.

Disclaimer

This document and any attachments are intellectual property owned by CDAM (UK) Limited and are protected by applicable copyright and trademark law.

Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed.

This material is not an invitation to subscribe for shares or interests in any fund and is by way of information only. The information is as of the date(s) indicated in this document, is not complete, is subject to change, and does not contain certain material information regarding any CDAM investment strategy, including tax consequences and risk disclosures. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.