Quarterly Review

In the second quarter, our portfolio underperformed in April and May, stabilised in June and began recovering in early July. Breaking down the Strategy's Q2 return into our favoured Total Shareholder Return (TSR) metric, the aggregate one-year forward earnings expectations slightly declined, in contrast to the MSCI World's 2.6% improvement. This decline indicates a small Price-to-earnings (P/E) contraction for our portfolio, while the MSCI World's multiple remained unchanged. In the short term, forward earnings estimates are market sentiment indicators. We read the slight decline in our numbers as neglect rather than adverse developments.

The underperformance in the first half of this year is well above the portfolio's historical movements and is primarily due to investors scrambling to gain exposure to AI. We do not expect this to persist.

Several idiosyncratic drivers and broader market themes have influenced our portfolio's performance. Notably, our roll-ups (serial acquirers) acquisition pace, the unwinding of peak COVID demand, and perceived AI impacts on software have been significant individual drivers. Additionally, broader themes such as momentum, market capitalisation, Earnings Per Share (EPS) divergence, and interest rates have played crucial roles.

The recent shifts in interest rate sentiment and portfolio earnings have been pivotal in fueling the portfolio's recovery. We anticipate that 2024's second-half earnings growth will surpass expectations and exceed market growth, further improving our portfolio's performance.

We believe the market is currently experiencing a Position Bubble rather than a Valuation Bubble. The "Gang of Four" (Microsoft, Nvidia, Amazon, Meta) dominates the major indices returns, accounting for over 60% of the S&P 500's year-to-date performance. This unprecedented market concentration has led to 38% of new equity money flowing into these top stocks. Investor AI FOMO (Fear of Missing Out) has driven the surge into the largest companies at the expense of everything else. This tech wave is unique because only companies with extraordinary amounts of capital can participate in the AI build-out.

Despite an unproven long-term AI business model, these leading companies are priced for perfection. All market indicators show investors from institutional to retail are overly long on the Gang of Four and short on everything else, particularly small-caps, presenting an enormous and ignored opportunity. Higher interest rates initially fueled this trend due to debt levels and EPS growth disparities, which are reversing. Similar to last year, the move can be swift.

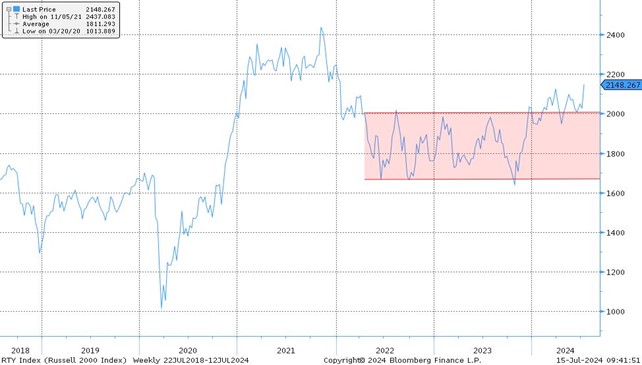

Supporting the reversal is the small-cap's break out from their 30-month range (see chart below). Small-caps have languished over the past two years while large-cap indices made new highs. Sentiment and earnings reversal should reinforce the new trend higher. Furthermore, in the second half of this year, the EPS growth of the "other" 496 stocks in the S&P 500 are expected to outpace super-tech stocks for the first time in two years. We anticipate significant outperformance driven by earnings and multiple reversals.

Small-caps have broken out of their 30-month range.

Portfolio Review

During the quarter, we made several strategic reallocations to optimise our portfolio. We divested from two cyclical companies, the proceeds from which were reinvested into a new investment and existing positions.

Since February, popular narratives surrounding Large vs. Small Cap and Momentum have heavily influenced equity markets and our performance. However, they are not the only factors at play. Our analysis identified four key idiosyncratic drivers that have played a more prominent role:

- Peak COVID,

- Interest Rates,

- Rate of Acquisition, and

- AI vs. Software.

More than half of our companies have been affected by at least two of these idiosyncratic drivers. After a frustrating six months, our analysis suggests that these drivers are shifting in our favour. The subsequent paragraphs detail the effect of this shift on our portfolio.

We estimate the enormous demand created by COVID-19 in 2021 accelerated revenue and inventory builds by almost two years. For many companies, this also marked peak valuations. It took as many years to return to a normal cycle, creating a harsh divergence in comparable quarters and years compared with tech's AI revival. As these companies return to pre-COVID trajectories, we see a recalibration of their valuations.

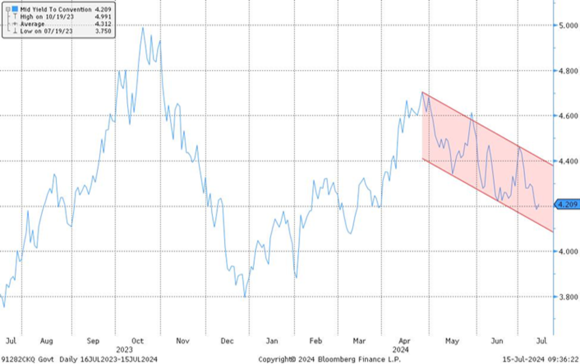

Interest rates have had direct and indirect impacts on our companies, due to their industry or debt structures. Recent economic data suggests that the US Federal Reserve may begin lowering US rates in September, which could provide a tailwind for our interest rate-sensitive holdings.

Roll-ups (serial acquirers) comprise over half of our portfolio. Due to peak valuations in 2021 and wide bid/offer spreads, their acquisition pace has been below trend. Market data suggests private valuations are rationalising and transaction activity is increasing. We expect this normalisation to improve the performance of our roll-up investments.

The AI hype has disproportionately impacted the software sector, leading to a pause in IT spending and multiple contractions for many of our companies. However, strong indicators suggest AI will likely catalyse a new spending cycle, benefiting our software holdings.

Closing Remarks

The past six months have been challenging, but by the end of June, our portfolio had stabilised and begun rebounding in early July.

Our portfolio has consistently demonstrated resilience and recovery amid market fluctuations, thanks to our strategic reallocations and robust investment approach. We anticipate this trend to continue. Exceptional events such as the Great Financial Crisis, the European Debt Crisis, and the pandemic have tested our methodology and processes. However, the lessons learned and adjustments made during these trials have strengthened our Strategy.

While our portfolio underwent extensive stress testing, the unique combination of idiosyncratic factors and broader market themes that emerged post-pandemic presented unprecedented challenges. Despite these difficulties, our investments have proven resilient. The key takeaway is clear: well-researched, high-quality companies led by exceptional capital allocators endure.

Note

This is a redacted version of CDAM's Q2 2024 Investor Newsletter. Should you be interested to learn more, please contact us by emailing ir@cdam.co.uk.

Disclaimers

This document and any attachments are intellectual property owned by CDAM (UK) Limited and are protected by applicable copyright and trademark law.

Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed.

This material is not an invitation to subscribe for shares or interests in any fund and is by way of information only. The information is as of the date(s) indicated in this document, is not complete, is subject to change, and does not contain certain material information regarding any CDAM investment strategy, including tax consequences and risk disclosures. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.