Quarterly and Year-End Review

At the close of 2023, we observed our portfolio's P/E and P/FCF multiples were approaching their upper limits and expected the portfolio would generate its return from both minimal multiple expansion and above market annualised EPS growth.

We anticipated earnings growth would drive returns while multiples normalised through attrition. Historically, strong markets have sustained or even expanded valuation multiples. However, 2024 defied this pattern. Despite our companies’ sales and earnings outperforming the market, they experienced significant multiple compression while AI enthusiasm drove expansion across broader indices.

The divergence between our portfolio and market multiples stems from a straightforward reality: although our companies demonstrated stronger fundamentals, they failed to meet elevated market expectations while investors gravitated toward popular stocks and AI themes. Momentum has been a dominant force in market returns over the past two years, working both ways – excessively driving stocks higher and lower. Companies unable to exceed short-term market expectations have faced particular challenges. Whilst our companies satisfied analysts in 2023, their underperformance on earnings reports was costly in 2024.

This pattern echoes previous technological disruptions. During the Dotcom era, "New Economy" stocks soared as fear of missing out on the technological revolution drew in retail investors. In contrast, "Old Economy" stocks faced double penalties – once for missing expectations and again for their traditional business models. Value stocks suffered the most, exemplified by Berkshire Hathaway's 20% decline in 1999 against the market's 25% gain.

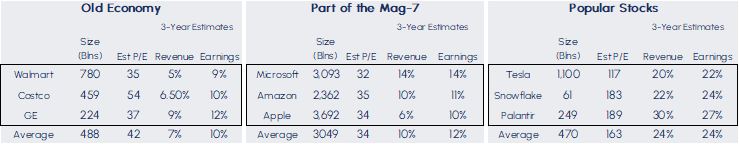

Looking ahead to 2025, conditions appear different. Our portfolio now trades at valuation lows, significantly below index levels, with reduced investor expectations limiting downside surprise potential. Conversely, the broader market faces risk from elevated valuations and high expectations, and these higher valuations are not limited to new technology. Old Economy stocks like Walmart, Costco, and General Electric are trading at valuations never seen before, not even as start-ups! The following tables of Old Economy, Popular Stocks, and some of the Magnificent-7 highlight the dislocations and extremes currently evident in the market.

We believe long-term success depends not on assessing technology's societal impact or growth rate but on evaluating the durability of competitive advantages. Recent developments suggest AI's barriers to entry may be lower than anticipated, with increasing competition likely to pressure growth and margins.

Our strategy has been built on interest rates and earnings. If earnings growth is our return engine, interest rates are an accelerator. Although other meaningful variables can affect a company's short-term valuation, the effect of interest rates over the long run determines the speed of earnings growth. At the start of 2024, investors expected the US Federal Reserve to gradually cut interest rates, lowering the cost of capital and raising asset valuations. By mid-year, this prospect started to fade, and by year-end, rates were back where they started. We have a few companies linked to interest rate changes, and their multiples all contracted in the fourth quarter as yields increased. The tripling of interest rates since 2022 is a major explanation as to why the companies with calculable earnings have struggled to grow materially (the Other 493 of the S&P 500).

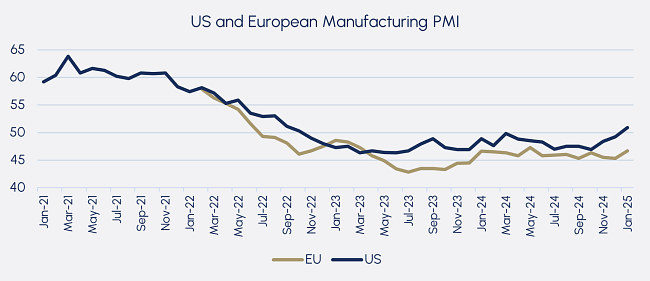

At the portfolio level, we identified three other factors that helped explain our companies’ performance. We believe the continued process of working off Peak COVID excesses is an overlooked but substantial headwind for the manufacturing sector, and for some of our companies. The US and European Manufacturing Survey (see below graph) has closely tracked this factor. For over two years (the most prolonged period in its history), this sector has been contracting, which correlates well with what our companies have reported. Recent data suggests potential improvement.

Portfolio Review

We ended the quarter and year with over half of our companies being acquirers. This increased during the year to the highest level since inception. We believe their undervaluation makes it an ideal time to increase exposure.

Our sector and geographical exposure remained unchanged from Q3, with the portfolio highlighting Information Technology and Canada, respectively. Our lower weight to the US market caused a negligible drag on last year's performance.

The portfolio valuation remains at the bottom of its historical range and is deeply discounted to comparable investments.

Our investment strategy centres on price-to-free cash (P/FCF) as our primary valuation metric, recognising that a company's reinvestment of cash is the fundamental driver of long-term returns. Currently, our portfolio trades at a considerable discount on this measure relative to historical levels, presenting a compelling opportunity.

What sets our portfolio apart is our companies’ exceptional reinvestment discipline. The majority of our companies’ free cash flow is allocated to growth opportunities, more than double the MSCI World Index's 42%. This difference becomes stark when calculating potential earnings growth using Return on Equity (ROE) and reinvestment rates.

We project a healthy five-year annualised Total Shareholder Return (TSR), factoring in core earnings growth, potential multiple expansion, and dividend yield. This projection becomes even more attractive when considering the additional return our companies generate through acquisitions. Our return engine is positioned to deliver more than twice the performance of comparable indices.

An often overlooked but crucial factor in our investment approach is management alignment with shareholder interests. Our portfolio companies' CEOs have, on average, nine times more personal capital invested than industry peers, creating strong incentives for long-term value creation.

While recent performance has temporarily deviated from our historical trend, we expect a return to our normal trajectory in the coming year, and the primary driver will be earnings growth. We are confident that our portfolio is well-positioned to resume its pattern of superior returns.

The latest CEO conservatism has lowered expected earnings growth for our companies and the market in Q4 2024 and pushed it out to Q2 and Q3 2025.

Closing Remarks

As we reflect on 2024, we find the market's behaviour to be similar to previous technological disruptions, particularly the late 1990’s Dot-Com era. Today's enthusiasm for AI-related, large-cap investments, coupled with severe multiple compression in contemporary industries, has created an environment where market momentum often overshadows fundamental business performance.

The widespread weakness reported by our CEOs suggests significant headwinds in the underlying economy beyond the AI sector. This broad-based softness, combined with the challenging interest rate environment, echoes the late 1990s when underlying economic deterioration was masked by technology sector enthusiasm.

However, our portfolio's positioning gives us confidence in its ability to generate superior returns. Our companies now trade at significant discounts to their historical valuations and the broader market while maintaining stronger fundamentals. We believe the foundation for future returns remains robust.

Last year was challenging for CDAM, with plenty of introspection and lessons learned. While recent performance has temporarily deviated from our historical pattern, we expect our strong projected five-year annualised Total Shareholder Return to materialise as market dynamics normalise. History suggests these periods of dislocation can persist for 12-18 months, but they inevitably give way to fundamentals. The current environment may create near-term volatility, but these conditions often present opportunities for patient investors focused on fundamental value creation. We remain confident that our portfolio of high-quality businesses, led by owner-operator management teams, is well-positioned to deliver compelling long-term returns for our investors.

Thank you for your continued support. Please let us know if you have any other questions.

Note

This is a redacted version of CDAM's Q4 2024 Investor Newsletter. Should you be interested to learn more, please contact us by emailing ir@cdam.co.uk.

Disclaimers

This document and any attachments are intellectual property owned by CDAM (UK) Limited and are protected by applicable copyright and trademark law.

Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed.

This material is not an invitation to subscribe for shares or interests in any fund and is by way of information only. The information is as of the date(s) indicated in this document, is not complete, is subject to change, and does not contain certain material information regarding any CDAM investment strategy, including tax consequences and risk disclosures. No investment strategy or risk management technique can guarantee return or eliminate risk in any market environment.